On 26 July 2021, the Hong Kong Monetary Authority (HKMA) launched Issue #2 of its Regtech Adoption Practice Guide series, which aims to provide financial institutions with detailed practical guidance on how to successfully implement RegTech solutions.

Each issue of the series focuses on a different technology or application area with the objective of driving RegTech adoption in the Hong Kong banking sector. While the first Guide in the series outlined the benefits of Cloud-based Regtech solutions, this second issue focuses on Regtech solutions applied to “Anti-Money Laundering/ Counter-Financing of Terrorism” (AML/CFT) specifically for the ongoing monitoring of customers.

The reason for choosing use cases of ongoing monitoring of customers is mainly due to the industry challenges that persist in this area. Many financial institutions are struggling to strike the right balance between meeting KYC management requirements after onboarding and the need for a positive customer experience. At the same time, numerous compliance teams are still relying on highly manual processes to gather comprehensive and up-to-date information in relation to customers and their transactions.

Below you can see an overview of the key sections included in the newly released HKMA Guide. Click here to access the document in full.

SECTION 1: Introduction of commonly observed challenges and developments in the ongoing monitoring of customers

The guide first identifies key challenges in the area of on-going Customer Due Diligence (CDD), including:

- Heavy manual workload in performing CDD reviews

- Negative customer experience, depending on how customer outreach is conducted

- Reliance on customers’ notification of changes

- Challenges in optimising the use of data related to the customer in its totality

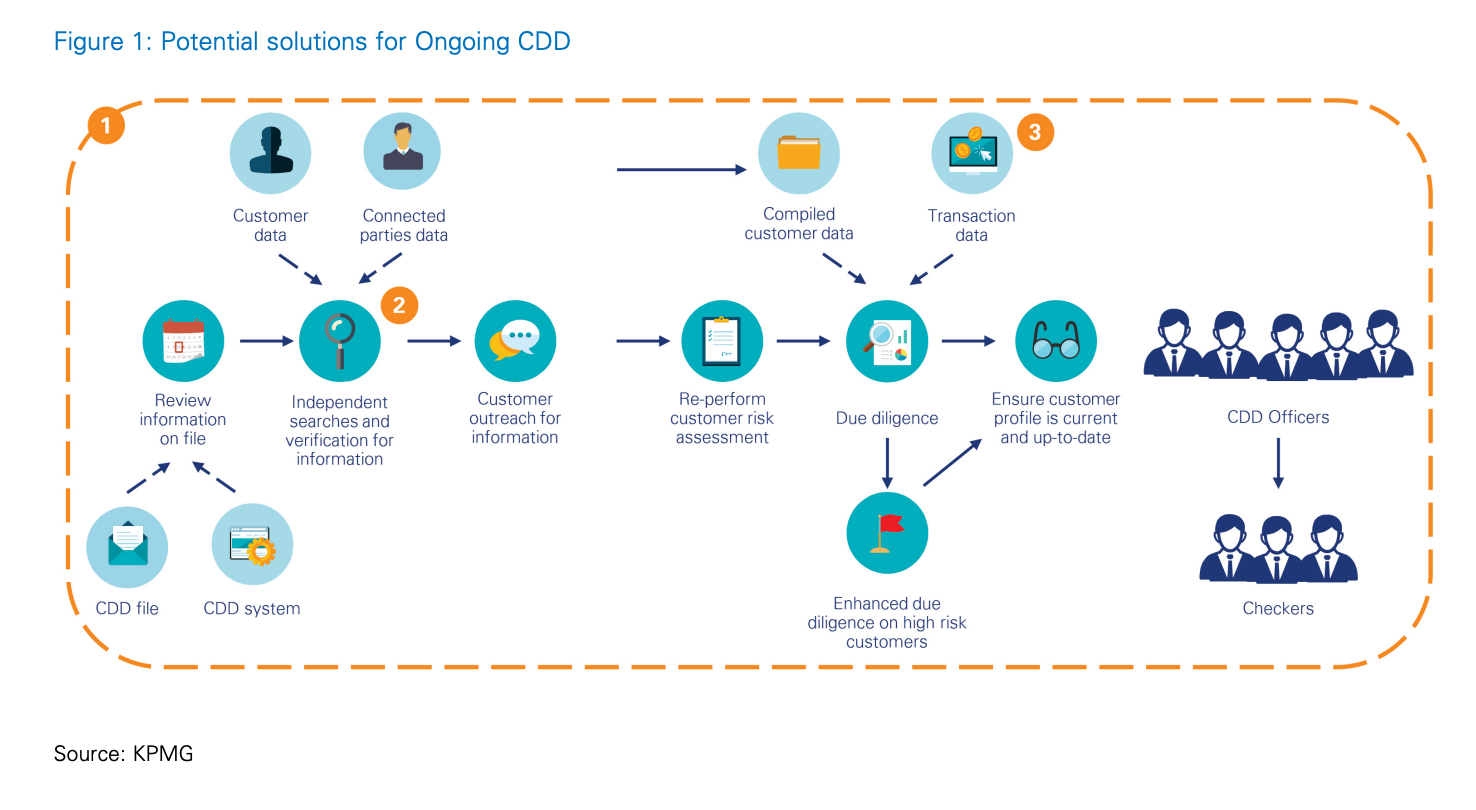

The diagram below illustrates the possible RegTech solutions that FIs can implement to tackle pain points related to Ongoing CDD. These include:

- An integrated backend platform that incorporates intelligent workflows and automation capabilities to reduce manual activities related to CDD combined with a user interface enabling customers to provide and manage personal data

- Cognitive computing solution that performs searches, categorisation, filtering, and analysis of financial crime information about the research subject, such as an existing customer

- Analytics and visualisation in customer activity review to enable a more integrated approach to monitoring

In the area of transaction monitoring, on the other hand, key issues arise from:

- Limitations of rule-based monitoring to the rules defined

- Challenges in segmenting customers

- Challenges in designing scenarios

- Challenges in setting and maintaining scenario thresholds

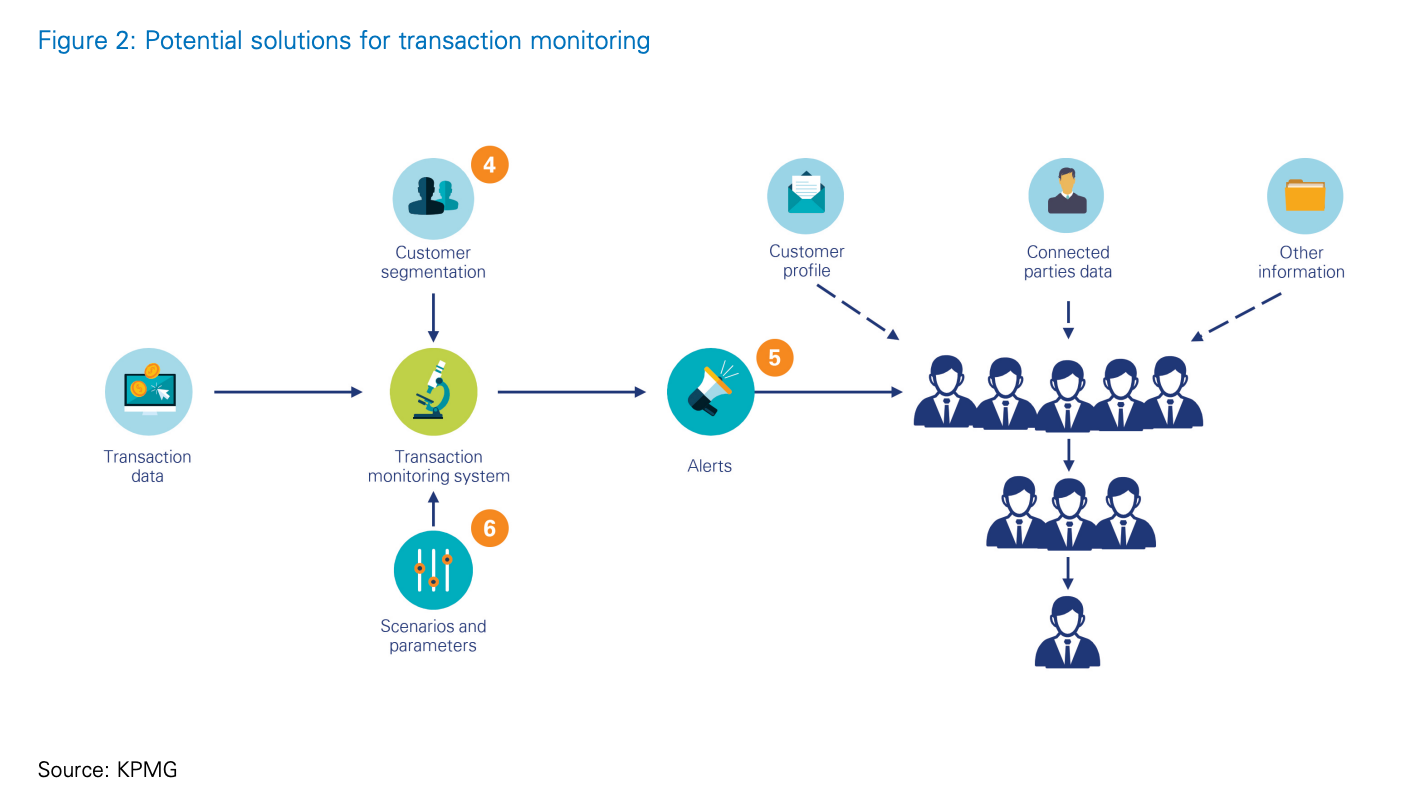

Possible solutions to tackle the above pain points related to Transaction Monitoring are represented in the figure below. These include:

- Customer segmentation powered by machine learning

- Machine learning for the classification of transaction monitoring alerts to alleviate the compliance teams’ manual workload in reviewing large quantities of alerts and heavy reliance on experience and judgement in the initial levels of review

- Robotic process automation (RPA) in the phase of transaction monitoring threshold tuning to address challenges in setting and maintaining scenario thresholds

SECTION 2: Practical implementation guidelines to banks on the adoption of AML/CFT RegTech solutions

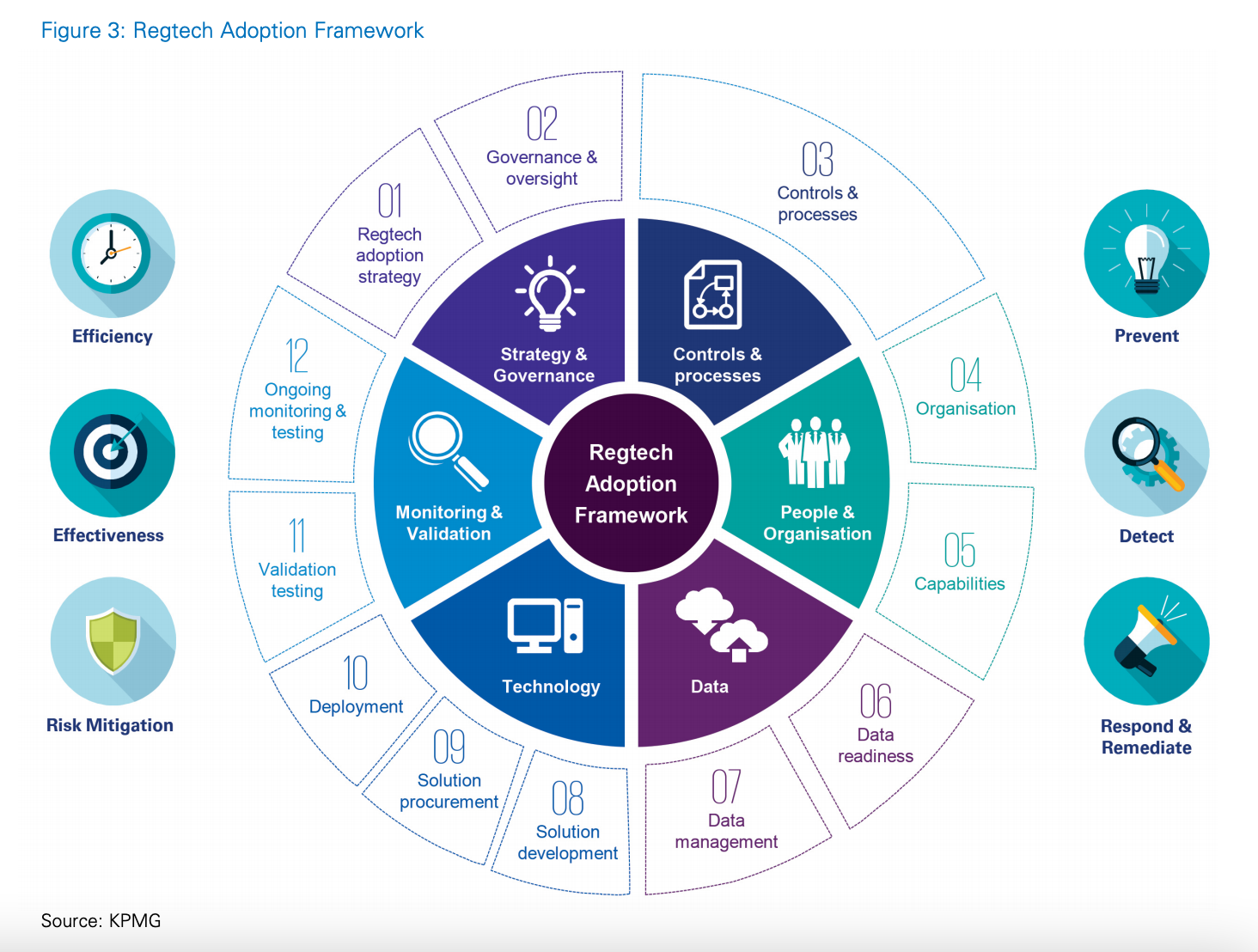

Most banks that have adopted RegTech to date have not followed a set framework for adoption. However, an adoption framework has the potential to provide better structure to the adoption journey, enabling institutions to better understand their current state as well as the future state and which steps are needed to bridge the gap between the two. The second section of the guide provides a conceptual framework for RegTech implementation – summarised in the diagram below – and key considerations when adopting Regtech for the ongoing monitoring of customers.

SECTION 3: Share use cases on adopting RegTech solutions to manage the ongoing monitoring of customers

The third and last section of the guide analyses three specific and fairly complex use cases of RegTech solutions implemented to manage the ongoing monitoring of customers. These are described as:

- Machine learning-powered customer segmentation

- Cognitive computing research solution

- Customer activity dashboard

Click here to access the guide and explore each of the above use cases in more detail.

If you’re looking for more information on HKMA’s recently released guidelines, we might be able to help. With our client onboarding solutions, financial institutions in Hong Kong can fully optimise their approach to KYC and on-going monitoring. Within our platform, clients can easily configure continuous AML screening and automate KYC remediation tasks based on assigned risk profiles.

As a Hong Kong provider of premium AML/CFT RegTech solutions, we can help your business evaluate, plan and implement a fully compliant and highly scalable digital onboarding and on-going monitoring strategy.

Last updated on March 21st, 2024 at 01:24 pm