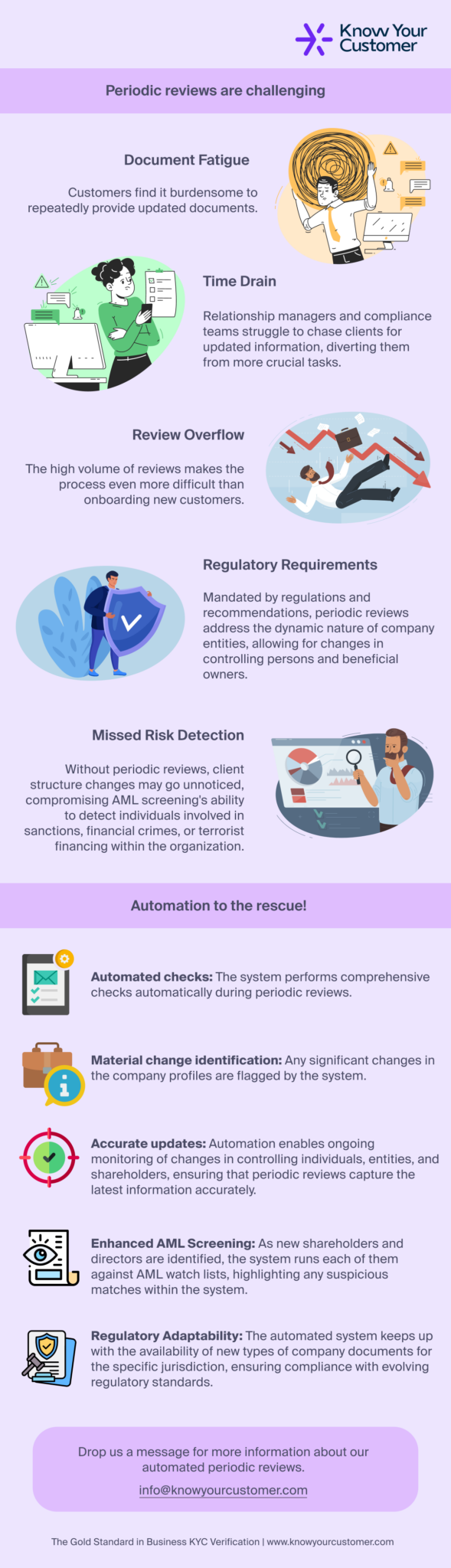

Periodic reviews are a crucial aspect of business Know Your Customer (KYC) compliance, enabling businesses to adapt to the dynamic nature of company entities and ensure ongoing AML screening effectiveness. However, these reviews often pose challenges for both customers and financial institutions. The burden of repeatedly providing updated documents can be taxing for customers, while relationship managers and compliance teams struggle to chase clients for the necessary information. Fortunately, automation offer a way to alleviate these challenges and enhance the efficiency of periodic reviews.

1. Overcoming Customer Burden:

Customers often find it burdensome to repeatedly provide updated documents during periodic reviews. Automation streamlines this process by eliminating the need for customers to manually submit documents each time through storing and verifying the information automatically, reducing customer fatigue and enhancing their experience.

2. Optimizing Resources:

Relationship managers and compliance teams often find themselves caught up in chasing clients for updated information, diverting their attention from more crucial tasks. With an automated business KYC solution, these teams can focus on high-value activities, while the system handles document collection, verification, and reminders for periodic reviews.

3. Efficient Handling of High Review Volumes:

The high volume of periodic reviews can overwhelm financial institutions, making the process even more challenging than onboarding new customers. Automated checks enable the system to perform comprehensive reviews efficiently, ensuring that the process remains manageable, even with a large number of reviews.

4. Identifying Material Changes:

During periodic reviews, it is essential to identify any significant changes in company profiles that may impact compliance or risk levels. Automated KYC solutions flag and highlight material changes in controlling individuals, entities, and shareholders, ensuring that critical updates are not overlooked.

5. Enhanced AML Screening:

Automated solutions play a vital role in enhancing AML screening during periodic reviews. As new shareholders and directors are identified, the system runs each individual against AML watch lists, promptly identifying any suspicious matches within the system and mitigating potential risks.

6. Regulatory Compliance:

Regulatory standards for business KYC evolve over time, necessitating adaptability. Automated business KYC solutions keep pace with changing regulations by integrating new types of company documents specific to each jurisdiction. This ensures ongoing compliance and reduces the risk of penalties or non-compliance issues.

Automated business KYC solutions offer a powerful solution to the challenges associated with periodic reviews. By streamlining the process, automating checks, and enhancing AML screening, these solutions optimize resources, improve customer experience, and ensure ongoing regulatory compliance. To learn more about how our automated periodic reviews can benefit your business, reach out to us at info@knowyourcustomer.com or book a demo with us below.

Last updated on May 2nd, 2024 at 01:30 am